matejmo/iStock via Getty Images

Bitcoin (BTC-USD) has been bleeding for months due to tight liquidity conditions and targeted selling of high beta technology stocks. Low interest rates since the global financial crisis in 2008 have led markets to reach extreme valuations. Now, the decade-long bubble has popped, and assets are moving back to reality.

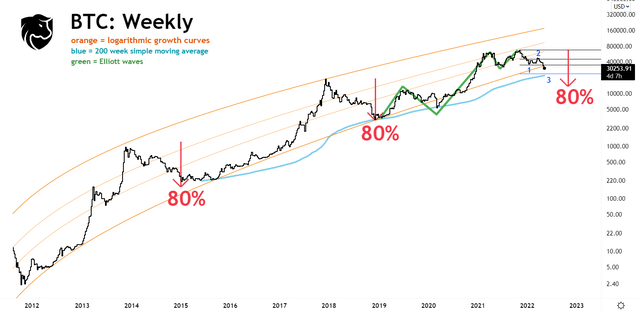

For most of Bitcoin’s existence, it has benefited from low interest rates. With rates now rising, Bitcoin’s price is suffering from the resulting uncertainty. In the near term, Bitcoin’s Wave 3 Elliott extension is signaling a crash to $21k. In the long term, Bitcoin’s Price Cycle outlook implies an 80% crash to $14k.

Bitcoin All-Time Chart (TradingView 5-11-22)

At BitFreedom Research, we believe the activities of the past 2.5 years will be remembered as the second dot-com bubble. The bubble popped in November 2021 when Bitcoin reached $68,990. Going forward, persistent sell pressure should kill any elements of the cryptocurrency market that do not provide tangible value.

Crypto Crash Long-Term Survivors

While the underlying internet technologies that powered the turn of the millennium dot-com bubble were solid, an overabundance of investments into the space caused an eventual crash. This same process has afflicted the cryptocurrency market, and the crash is occurring right now:

LUNA, First Collapse Of The Crypto Crash (TradingView 5-11-22)

By following the same rules that dictated the dot-com crash, we can infer there will emerge oligopolistic winners that grow to dominate each Web 3 sector. According to our own analysis, the following cryptocurrencies are the most likely to survive and thrive long into the future:

- Bitcoin: the invention of digital scarcity, BTC is the purest form of “Digital Gold.” Bitcoin’s high-level purpose is to be a storage-of-value, and as such its price should follow the natural long-term power-law growth curve.

- Ethereum (ETH-USD): the first-ever application of digital scarcity, Ethereum maintains a forceful network effect to draw in developers, investors, and users. The Ethereum network uses ETH as gas to generate trustless verification of a wide range of transactions.

- ChainLink (LINK-USD): the most widely used decentralized data network, Chainlink facilitates the transfer of tamper-proof data from off-chain sources to on-chain smart contracts. Decentralized data verification is a massive use-case that can lead Chainlink to tether the world’s economy through its application of “cryptographic truth.”

- Helium (HNT-USD): the largest provider of decentralized wireless infrastructure, Helium is building in preparation for a 5G world. By deploying low-power radio devices, Helium network participants provide coverage for IoT devices and earn HNT.

If we believe these projects will succeed, then it follows that there will a be a point of maximum opportunity (a bottom) at some point during the present bear market. To find potential bottoms, we are using Elliott Wave theory combined with Bitcoin’s Price Cycle theory.

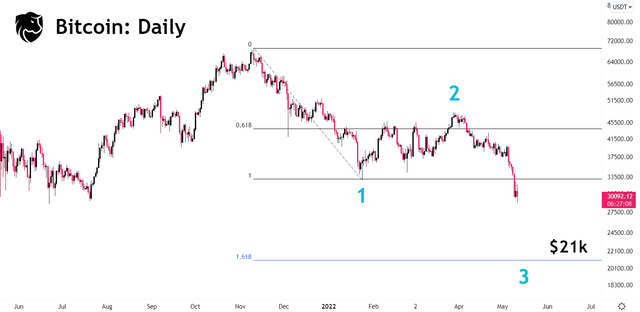

Bitcoin Elliott Waves

Bitcoin Elliott Waves (TradingView)

Looking at Bitcoin’s daily chart, the asset is currently moving in Wave 3 (the most powerful wave) of its long-term corrective phase. Wave 3 typically extends 1.618 the length of Wave 1. When charted, this Fibonacci extension implies Bitcoin will crash to $21k.

With Bitcoin in Wave 3, this implies a deeper move into Wave 5. To analyze how low a final Wave 5 can push Bitcoin, we are studying data from the asset’s previous 2 price cycles.

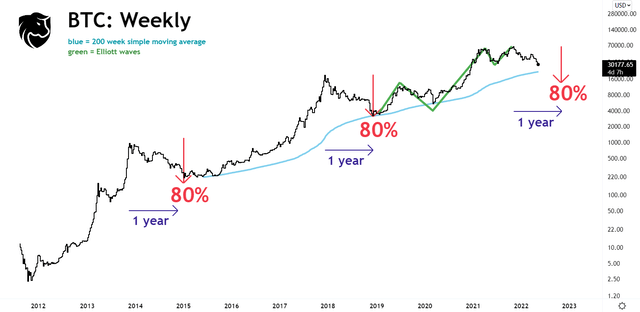

Bitcoin Price Cycle Bottom

After each parabolic run-up, Bitcoin has decreased from peak to trough by 80% approximately 1 year later. According to this movement, Bitcoin should reach $14k between October-November 2022.

Bitcoin Price Cycle Analysis (TradingView)

A major difference between the current crypto bubble and the previous dot-com bubble, is that the speed of the internet should make crypto’s drawdown and recovery occur much faster. Due to this, we expect the entire cryptocurrency crash and bear market to conclude near the end of 2022. In accordance with how bubbles typically pop, a dip below Bitcoin’s baseline growth trend (identifiable through the 200-week simple moving average) can take Bitcoin as low as $14k.

Which Projects Are Doomed?

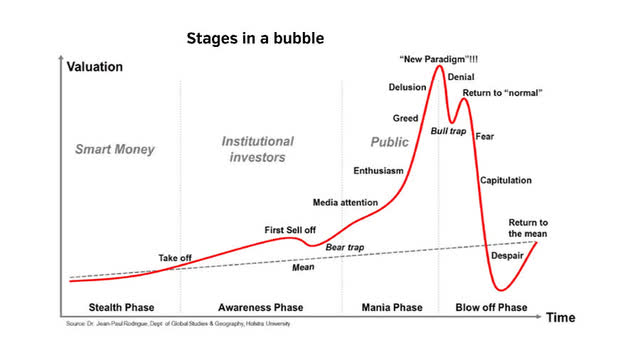

From a conceptual perspective, Bitcoin is currently in the Fear/Capitulation zone of the ‘Stages in a bubble’ diagram. Since Bitcoin’s previous bull run was so long and unhinged, toxic aspects of the market now must die before everything can heal.

Stages In A Bubble (Hofstra University)

The following bad actors represent Greed, Delusion, and New Paradigm practices that are typical of asset bubble tops. We expect each of these enterprises to collapse in the coming months:

- Stock-To-Flow Model – an incorrect predictive model which promoted reckless speculation through 2021.

- MicroStrategy – The corporation secured a $205 million loan from Silvergate Bank on March 29 to acquire an additional 4,167 Bitcoin at a price of $45,714 per coin. The loan will be subject to a margin call if BTC drops to $21k.

- Meme coins – examples include minimally developed play-to-earn games, pointless NFTs, and Ponzi scheme DeFi yield protocols.

- Rehypothecation – unprotected leverage in DeFi markets needs to collapse.

- Influencer Investors – most social media platforms are rife with crypto content creators who only provide bullish outlooks, as speaking bearish hurts their view count.

Going forward, each of these enterprises should die as Bitcoin returns to its baseline growth rate (the 200-week moving average).

Key Takeaways

- Bitcoin is currently moving in Wave 3 (the most powerful Elliott wave) which projects the asset to reach $21k.

- Due to the speed of the internet, the entire cryptocurrency crash and bear market can conclude near the end of 2022.

- A well-timed investment into any of the four projects mentioned above (BTC, ETH, LINK, and HNT) should be highly lucrative in the long term.

from WordPress https://ift.tt/opIBtk8

via IFTTT

No comments:

Post a Comment