If you’re looking to learn how to invest in stocks in a simplified way – then this beginner’s guide is for you.

Today, we talk about the importance of choosing a suitable broker and creating a risk-averse strategy, as well as which stocks are worth considering as a first-time investor.

To conclude, we will show you how to invest in stocks online without paying any deposit fees or trading commissions – from a minimum capital outlay of just $10.

How to Invest in Stocks – 4 Easy Steps

Even if this is your first time investing in the stock market, the process can be completed in a matter of minutes when using eToro – which charges nothing in commission.

Follow the quickfire guide below to learn how to invest in stocks right now.

Step 1: Open an eToro Account

Step 1: Open an eToro Account

Irrespective of which broker you like the look of, you will be required to open an account before you invest in stocks. At eToro, this simply requires some personal information from you – alongside a copy of your government-issued ID. Step 2: Deposit Funds

Step 2: Deposit Funds

Before you get to the stage of selecting the best investment stocks for your portfolio, you will need to deposit some funds into your eToro account. This top-rated broker requires a minimum of just $10 if you’re from the US – and no deposit fees are charged. Moreover, you can choose from ACH, debit/credit cards, e-wallets like Paypal, or a domestic bank wire. Step 3: Search for Top Stocks to Invest in

Step 3: Search for Top Stocks to Invest in

The easiest way to find the stock that you wish to buy is to utilize the search box at the top of the page. Simply type in your chosen company and click on the ‘Trade’ button to proceed to the final step. Step 4: Invest in Stocks

Step 4: Invest in Stocks

You will now see a user-friendly order box appear on your screen. You will need to type in the amount of money that you wish to invest in your chosen stock, before clicking on ‘Open Trade’ to confirm the order.

And that’s all it takes to invest in stocks when using a beginner-friendly broker like eToro. If you need more guidance on how to start investing in stocks, read on.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Broker for Stock Investing

Brokers sit between you and the stocks that you wish to invest in. As such, before you can invest in stocks today, you will need to open an account with a suitable broker.

The best brokers in this space offer access to thousands of US and foreign stocks at low fees and small account minimums.

If you need some inspiration on where to buy stocks from the comfort of home – consider the pre-vetted brokers that we review in the sections below.

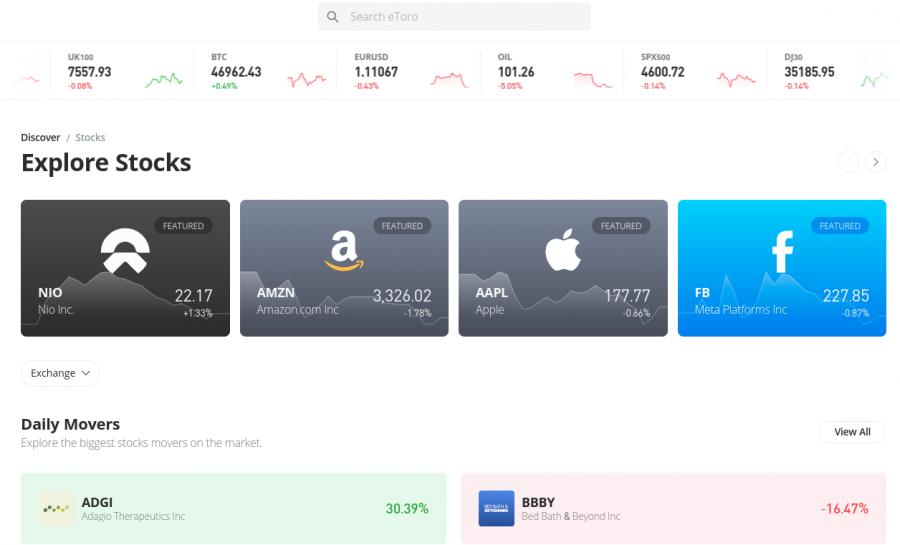

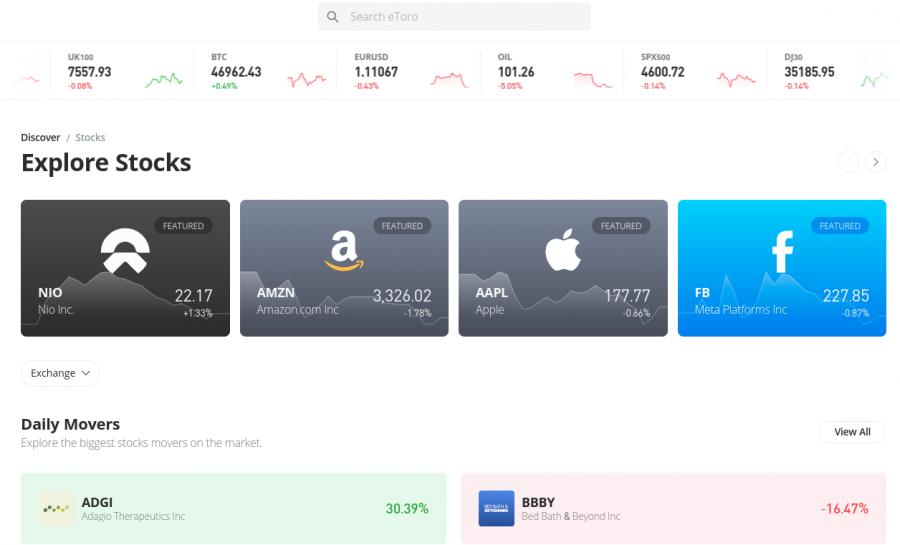

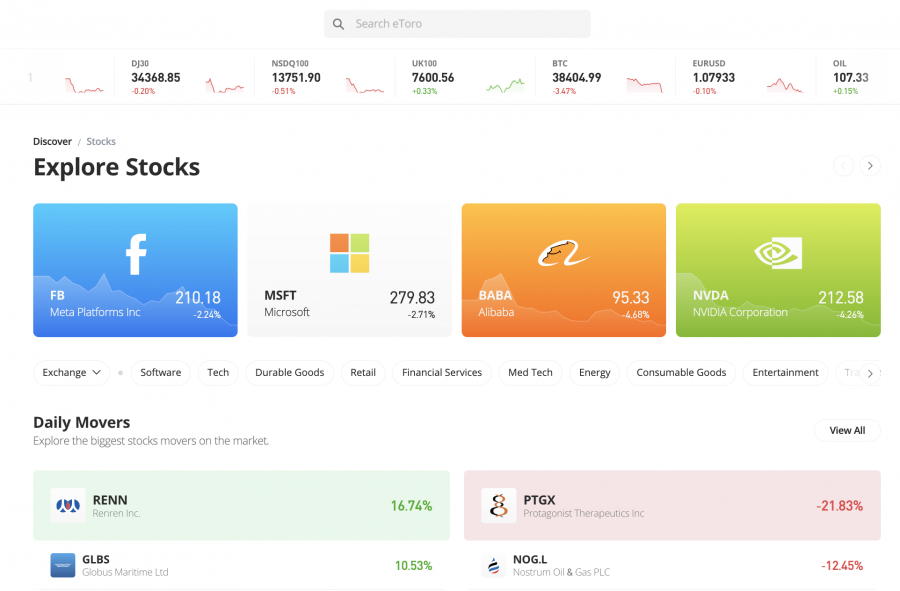

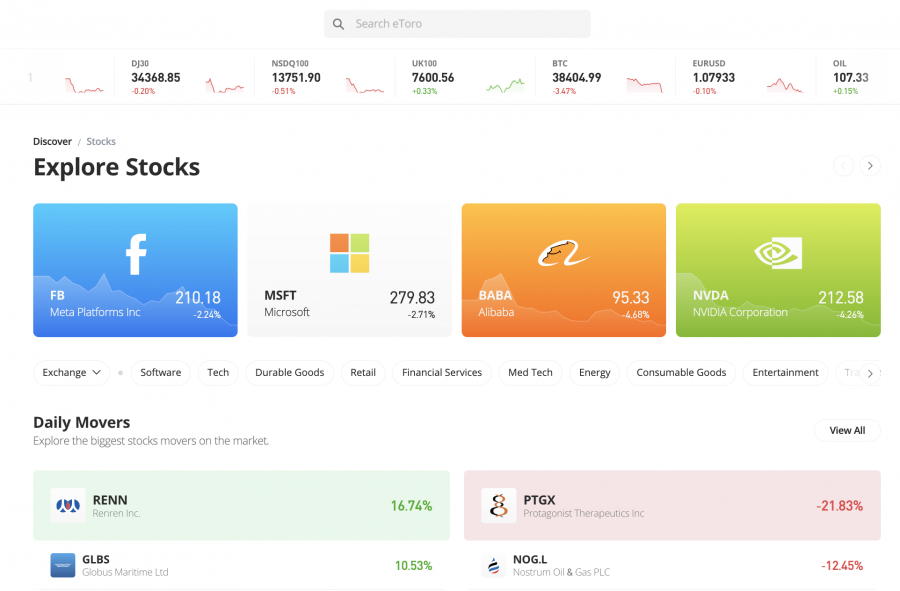

1. eToro – Overall Best Place to Invest in Stocks

If you are learning how to invest in stocks for the very first time – then choosing a user-friendly broker like eToro is a smart decision. You will find this broker easy to use even if you have little to no experience with how the stock markets work. Plus, opening an account and buying stocks on eToro is very straightforward – usually taking no more than five minutes.

If you are learning how to invest in stocks for the very first time – then choosing a user-friendly broker like eToro is a smart decision. You will find this broker easy to use even if you have little to no experience with how the stock markets work. Plus, opening an account and buying stocks on eToro is very straightforward – usually taking no more than five minutes.

Once you have opened an account with this top-rated broker – which is used by over 25 million people, US clients can deposit funds without paying any fees. Moreover, budget-conscious investors are catered for, as the minimum deposit is just $10. The easiest way to deposit funds is via a debit/credit card or an e-wallet like PayPal.

ACH and domestic bank wires are supported too. Either way, once you have made a deposit, you can then invest in stocks at the click of a button. At eToro, you will have access to thousands of equities across the US, Europe, Asia, and more. Regardless of whether your chosen stocks are listed in the domestic or overseas markets, eToro is home to a 0% commission policy.

This means that other than the spread – which typically sits below 0.20% on major equities, no fees are charged. We also like that eToro offers fractional shares from just $10 per trade. Therefore, regardless of how expensive your chosen stocks are, you only need to meet a minimum investment of $10. For example, this means that you can buy Alibaba stock with a minimum investment of just $10.

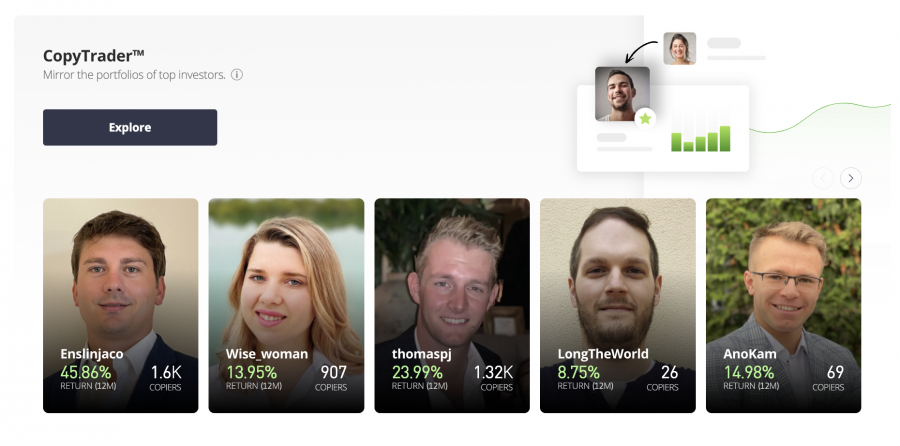

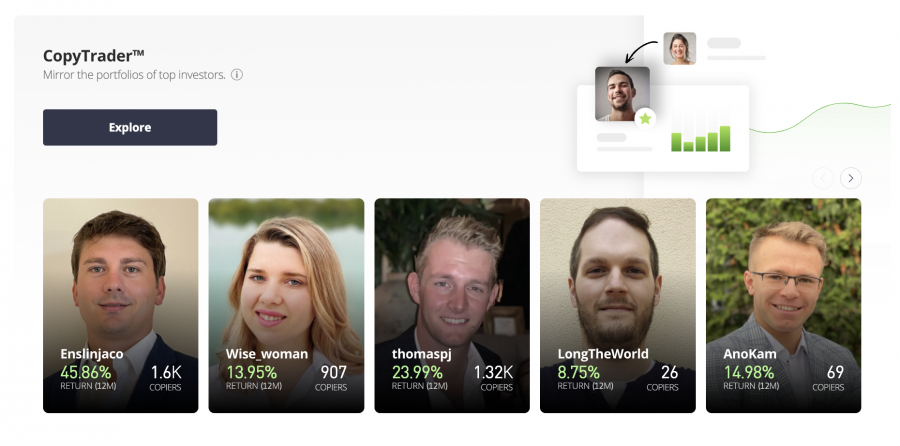

This will come in handy if you’re interested in stocks like Tesla, Amazon, or Berkshire Hathaway – all of which trade for thousands of dollars per share. eToro also offers an innovative feature called copy trading, which allows beginners to invest in stocks passively. All you need to do here is choose an experienced trader that you like and then all future investments will be copied. eToro also provides access to a wide range of markets from the best oil stocks to the best biotech stocks.

You can also invest in smart portfolios, which will suit newbies that wish to take a long-term approach to the stock markets but in a passive way. There is a wide variety of strategies to choose from and your smart portfolio will be rebalanced by eToro on your behalf. And finally, the eToro stock app is compatible with iOS and Android smartphones, and this links to your main account.

| Number of Stocks | 3,000+ |

| Deposit Fee | FREE for USD deposits |

| Fee to Invest in Amazon Stock | 0% commission |

| Minimum Deposit | $10 |

What We Like:

- More than 3,000+ stocks listed

- Invest in US and international stocks at 0% commission

- Minimum deposit only $10

- Regulated by numerous top-tier entities

- Accepts credit/debit card and PayPal deposits

- User-friendly trading app

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

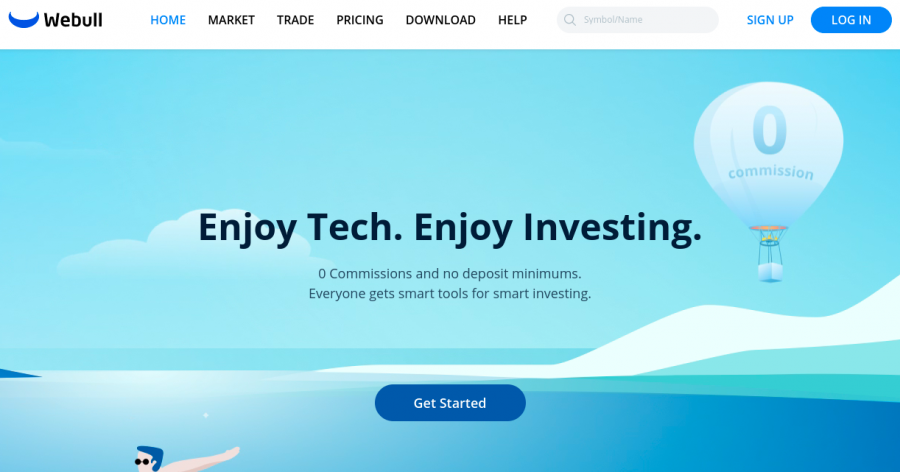

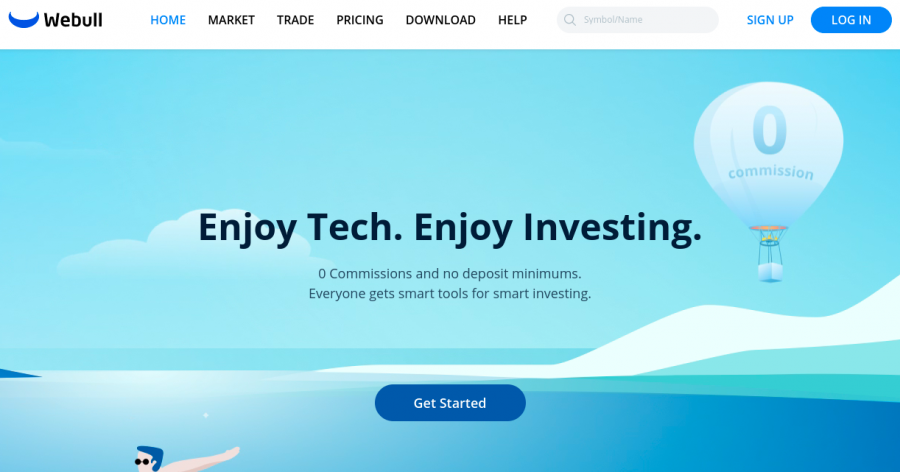

2. Webull – Invest in US Stocks From Just $5 at 0% Commission

Another option you have when learning how to invest in stocks is Webull. This online stock broker offers a user-friendly platform – which is also the case for its iOS and Android app. You can open an account with Webull relatively quickly and there is no minimum deposit requirement to meet.

Another option you have when learning how to invest in stocks is Webull. This online stock broker offers a user-friendly platform – which is also the case for its iOS and Android app. You can open an account with Webull relatively quickly and there is no minimum deposit requirement to meet.

As such, Webull will appeal to those of you that wish to invest in the stock markets with a small amount of money. When it comes to fees, ACH deposits are free. However, Webull charges $8 per domestic bank wire deposit, and $25 when withdrawing funds with this payment method.

In terms of trading fees, Webull is a 0% commission stockbroker. However, small and medium-cap stocks can come with less favorable spreads, so do bear this in mind before placing an order. We should also note that Webull is more suited for those that wish to invest in stocks that are listed in the US.

This is because the broker only gives you access to a few international stocks – all of which are offered in the form of American Depositary Receipts (ADR). Furthermore, additional fees will apply to ADR stock investment. Nonetheless, Webull might be suitable for you if you wish to invest in stocks via a tax-efficient retirement account.

There are many options in this respect, inclusive of Traditional and Roth IRAs. One of the main drawbacks of this broker is that it does not offer any passive investment tools – such as managed portfolios or copy trading. If you seek these beginner-friendly features, you will need to consider eToro.

In addition to US stocks, Webull also allows you to invest in cryptocurrency. There are many digital tokens to choose from, such as Bitcoin, Ethereum, Shiba Inu, and Dogecoin. Webull is also home to US-listed ETFs and stock options. Finally, although Webull is typically used by newbies, it does offer an extensive range of advanced trading tools and technical indicators.

If you can’t decide between these two top-rated crypto trading platforms, read our eToro vs Webull comparison review for a more thorough analysis.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – Free / Bank Wire – $8 |

| Fee to Invest in Amazon Stock | Commission-Free |

| Minimum Deposit | $0 |

What We Like:

- Minimum stock investment is just $5

- Great mobile app for beginners

Your capital is at risk.

Step 2: Research Stocks Investment

From start to finish, you can open a brokerage account and then invest in stocks in a matter of minutes.

However, to invest in stocks, you will be required to risk your hard-earned money. And as such, it’s a good idea to learn the fundamentals of the stocks markets before proceeding.

How Does Investing in Stocks Work?

In the sections below, we explain everything there is to know about investing in stocks as a complete beginner.

You are Buying a Share in a Company

The first thing to note is that when you invest in stocks, you are buying a share of the respective company. This will, of course, be a minuscule percentage in the grand scheme of things – but you will be a shareholder of the company nonetheless.

A simplified example of this can be found below:

- Let’s say that the company has 1 million stocks in circulation

- You decide to buy 1,000 stocks

- This means that you own 0.1% of the company

As we explain in more detail later, if the company that you own stocks in pays dividends, in this example, you would be entitled to 0.1% of the amount distributed.

Market Capitalization

The next thing to have a firm grasp of is the market capitalization of the company that you are investing in. This is crucial, as the market capitalization is what determines the value of the company.

This is calculated by multiplying the current price of the stock by the total number of stocks in circulation.

For instance:

- In the example above, we explained that the company has 1 million stocks in circulation

- We’ll say that at the time of your investment, the stock is trading at $1,000 per share

- This means that the company has a market capitalization of $1 billion

Stocks are typically categorized into three different areas when market capitalization is being discussed.

- Large-Cap – Over $10 billion

- Medium-Cap – Between $2-10 billion

- Small-Cap – Under $2 billion

If you are learning how to invest in stocks for the first time, then we would suggest sticking with large-cap stocks. These are typically established companies that not only dominate their respective markets – but are a lot less volatile.

For example, the likes of Amazon, Tesla, Microsoft, and Alphabet (Google) all carry market capitalizations of over $1 trillion.

Most importantly, if you’re looking for the best penny stocks to invest in – you should avoid this high-risk segment of the share trading scene.

This is because penny stocks are extremely volatile to the point that you could lose the entire value of your investment overnight.

Stock Prices

In order to make money from a stock investment (in addition to dividends – more on this later), you will need the value of your stocks to increase.

Like any investment that trades in a public setting, the value of your stocks will be determined by market forces.

For example, if there are more people buying Tesla stock in comparison to those selling, then the value of the stocks will increase. If the opposite happens – and there are more sellers in the market, then you can expect the value of the stocks to decline.

Stock Trading Hours

In the US, the stocks markets are open from 9:30 am to 4 pm (Eastern Time), Monday through to Friday. This means that you will only be able to invest in stocks during these hours. This is also the case when it comes to cashing out.

Some online brokers now offer out-of-hours trading. With that said, this should be avoided, as prices are a lot more volatile due to lower trading volume.

Stock Exchanges

Publicly-traded companies are listed on stock exchanges. In the US, the primary two exchanges consist of the NYSE and NASDAQ.

Should you wish to invest in stocks that are listed overseas, then you will need to choose a broker that gives you access to your chosen market.

eToro, for example, offers 0% commission trading across exchanges in the US, UK, Europe, Asia, and more.

How to Find the Best Stocks to Invest in?

Now that you have a basic understanding of how this trading space works, we can now explain how to find the best stocks to invest in.

This is a very important part of the learning process, especially when you consider that there are thousands of stocks trading on the NYSE and NASDAQ, and even more across the international markets.

Ultimately, not all stock investments are successful – so in the sections below, we explain the key factors to consider when building a portfolio

Type of Stock Investment

When learning how to invest in stocks for beginners, you will come across a wide variety of investment categories.

For example, blue-chip stocks refer to large-cap companies that are both established and dominant in their respective sectors. Examples of blue-chip stocks include Johnson & Johnson, Visa, JPMorgan Chase, and Pfizer.

Crucially, blue-chip stocks carry less risk than other investment categories, albeit, you might find that the upside potential is more limited. If you crave much higher returns, then you might look to invest in growth stocks.

These are companies that are still in the early stages of their incorporation and oftentimes, are involved in products or services that operate in an unproven marketplace.

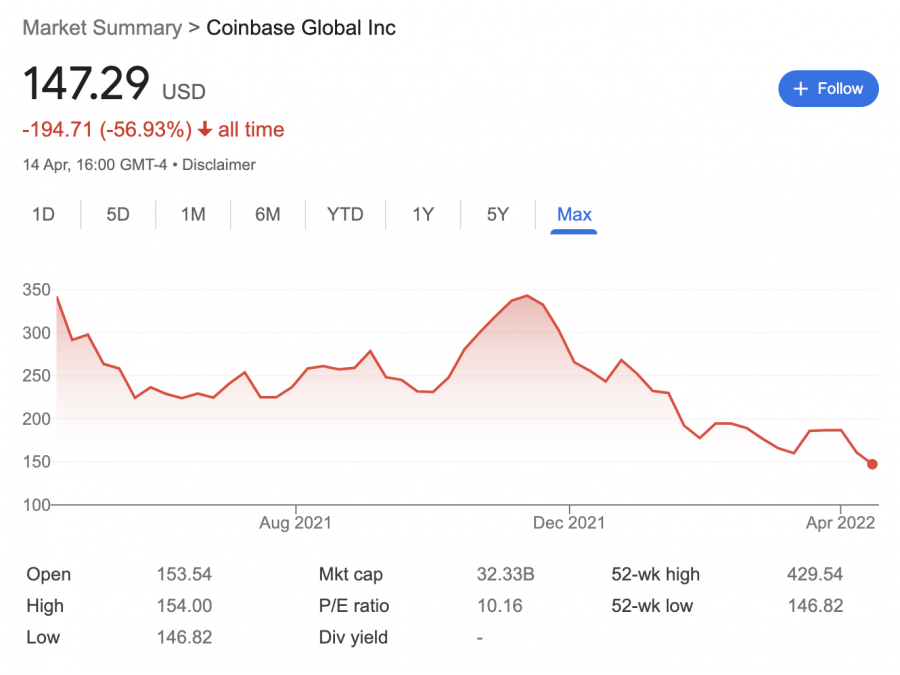

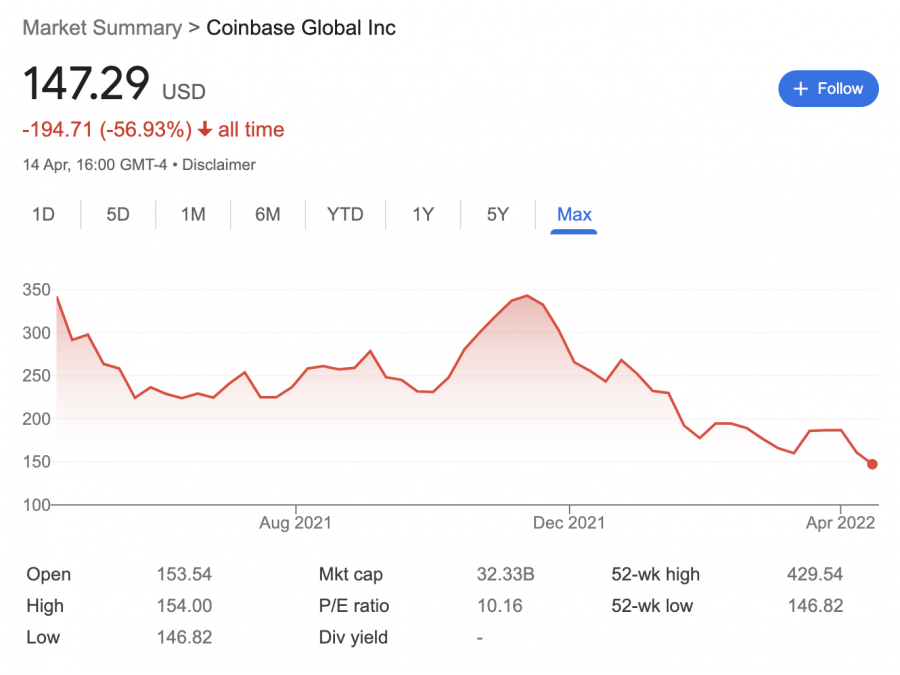

- A good example of a growth stock is Coinbase.

- Coinbase was founded in 2012 and it went public as recently as April 2021.

- Moreover, Coinbase is involved in cryptocurrency exchange services, so it’s most certainly a growth stock.

- In addition to Coinbase, you might also consider metaverse stocks or even cannabis stocks – should you wish to target high-growth companies.

Another option to consider is investing in dividend stocks. As the name suggests, these are stocks that have a dividend policy in place – which means that as a shareholder, you will receive a payment every three months.

The best dividend stocks in the market have been making contributions for many decades. In fact, dividend ‘kings’ like Coca-Cola and Johnson & Johnson have increased the size of their quarterly payments consecutively for over 60 years.

Stock Sector

Once you have identified the stock type that interests you, the next thing to consider is the specific sector that the company operates in.

In total, there are 11 stock market sectors, which we have listed below:

- Information Technology

- Health Care

- Financials

- Consumer Discretionary

- Communication Services

- Industrials

- Consumer Staples

- Energy

- Utilities

- Real Estate

- Materials

Within each of the above stock sectors, companies can be narrowed down by the respective industry. For example, energy stocks contain companies involved with oil, natural gas, renewables, and more.

When deciding on which sectors to invest in, a number of considerations need to be met. For instance, energy stocks are known for their volatility and attractive dividend yields.

You then have the utilities and real estate sectors, which are associated with slow and steady growth, consistent dividends, and relatively low volatility swings.

The information technology sector is known for its high growth, especially in the case of Big Tech firms like Apple, Facebook, and Google.

The best way to approach the stock markets is to build a portfolio that covers a wide variety of sectors. This diversification strategy will enable you to mitigate your risk, by ensuring that you are not overexposed to a small number of markets.

Performance vs the Wider Markets

It is also a good idea to spend some time comparing the performance of your chosen long-term investment stocks against the broader markets. There are many ways that you can do this.

For example, you can see how your chosen stock has performed over the prior one and five years and then compare this with the average for the exchange that the stocks are listed on.

- Ford Motors, for instance, has seen its stock price increase by 27% in the prior year.

- While the NYSE Composite has grown by less than 3% during the same period.

Another way that you can compare stock prices with the broader market is to look at an index fund that tracks the respective sector or industry.

- For example, Bank of America stocks have increased by 65% over the prior 12 months.

- In comparison, the Invesco KBW Bank ETF – which tracks the performance of US-based banking stocks, has increased by 30% during the same timeframe.

Alternatively, you might even consider comparing the performance of your chosen stock against other companies in the same marketplace.

- For instance, if you were looking to buy oil stocks, you might look at ConocoPhillips – which is up nearly 100% over the past year.

- Fellow oil competitors Shell and BP, however, are up just 56% and 23% over the same period.

Ultimately, although the past performance of a stock does not illustrate its future direction, this does allow us to see how the company is performing when compared to the wider industry, sector, or markets.

Look for Undervalued Stocks

Even if you are a complete beginner in the investment space, it’s a great idea to try and find some undervalued stocks for your portfolio.

These are stocks that are trading at a lower price than they are actually worth. Of course, this is subjective, which is why it is important to do lots of research before investing.

The first step in finding undervalued stocks is to look at the P/E ratio of the company and then compare this with the industry average. The P/E ratio is calculated by dividing the current share price of the stock into its earnings per share.

For example, let’s say that the average P/E ratio for the pharmaceutical industry is 30 times. If you are looking at a pharmaceutical stock that carries a P/E ratio of 20 times, then it could be undervalued. However, if the stock has a P/E ratio of 35 times, then it could be overvalued.

You can also look at the fundamentals when searching for undervalued stock investments.

For example, the stock price of the company might have gone down because of recently reported earnings that fell short of market expectations. But, the share price decline might not be justified if the shortfall was minute.

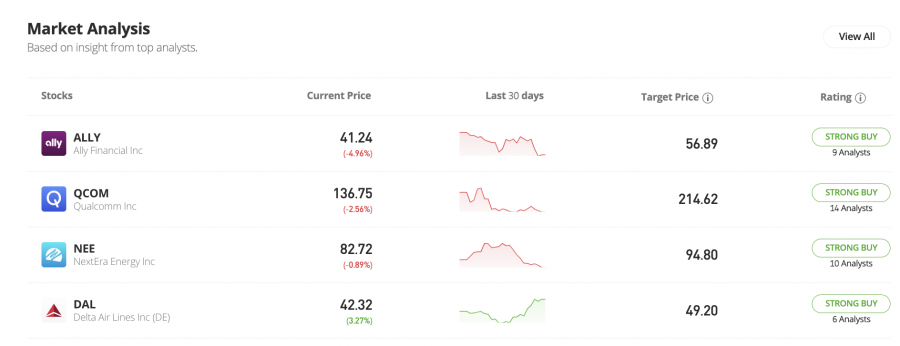

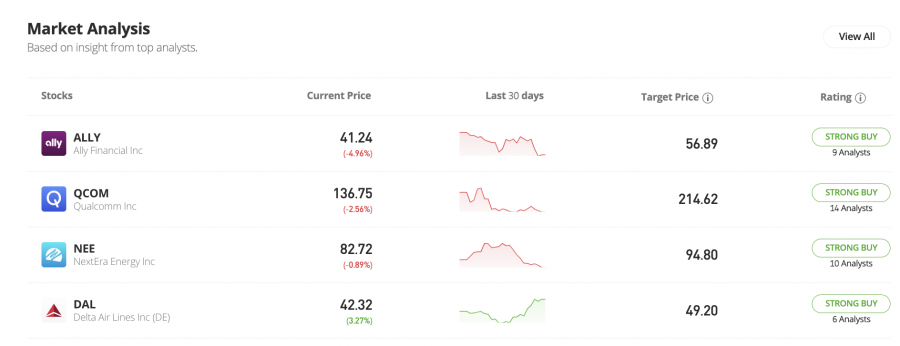

5 Best Stocks to Invest in Right Now?

In following the above tips on how to find the best stocks to invest in right now, you can be sure that you are choosing companies that align with your financial goals.

With that said, if you’re looking for some inspiration on which stocks to add to your portfolio right now – consider the five firms discussed below.

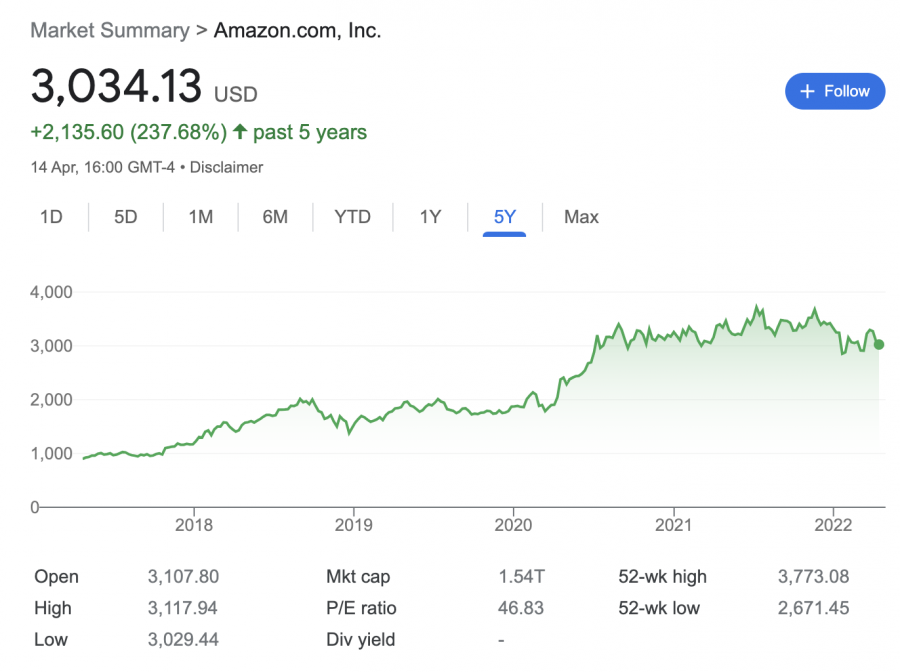

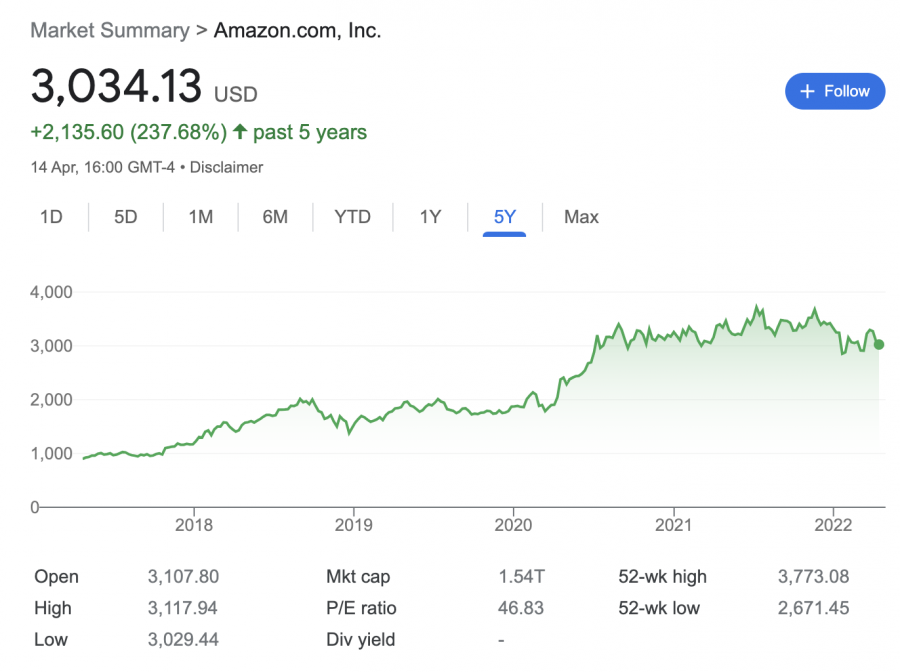

1. Amazon – Overall Best Stock to Invest in

Amazon was founded in 1994 and the firm went public just three years later. Since then, the value of Amazon stocks has increased by more than 175,000%. This means that had you invested $5,000 into Amazon back in 1997, your money would now be worth over $8 million.

Although Amazon is not a dividend-paying company, the firm continues to reward shareholders in the form of continued growth that in many cases, outperforms the broader markets. For example, over the past five years of trading, Amazon stocks have increased in value by more than 235%. In comparison, the NASDAQ Composite has grown by 125%.

Crucially, it could be argued that Amazon is a stock that you might consider buying and leaving in your portfolio for many decades. While the firm dominates the online retail industry, Amazon is a market leader in many other areas. This includes everything from cloud computing and streaming services to groceries and drone deliveries.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Coca-Cola – Best Dividend Stock to Invest in

When you invest in stocks that pay a dividend, you will receive a share of any payments that are distributed – which is usually every three months. Although you might be keen to explore high-yield dividend stocks, you might want to focus on a company like Coca-Cola – which has been making quarterly distributions for over 60 years.

Moreover, Coca-Cola has increased the size of its annual payment each year during this period, which makes it a leading dividend king. As such, if you were to invest in Coca-Cola stocks, you are buying stocks in a dividend-paying company that has been consistent for no less than six decades.

As of writing, Coca-Cola is offering a running dividend yield of over 2.7%, which is competitive. Moreover, the value of Coca-Cola stocks, over the prior one and five years, has increased by 20% and 50% respectively. This is in addition to its ongoing dividend program, so when you invest in this stock, you can increase the value of your capital on two fronts.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

3. Coinbase – Best Growth Stock to Invest in

Even as a beginner, it is a good idea to invest in a small collection of top-rated growth stocks. This will enable you to target above-average market gains. Perhaps the best growth stock to consider today is Coinbase – which is one of the world’s largest cryptocurrency exchanges with nearly 90 million clients on its books.

This growth stock first hit the NASDAQ exchange in April 2021 at over $340 per share. However, the markets seem to be undecided on this stock, with Coinbase since seeing its share price decline by over 50%. This shouldn’t put you off though, as Coinbase has a solid framework in place to benefit from the ever-growing rise of the cryptocurrency industry.

Don’t forget, even in its current form, the cryptocurrency industry is worth well over a trillion dollars. And as this figure continues to increase, Coinbase’s regulated and trusted reputation will ensure that the exchange is at the forefront of new investors that wish to enter the market for the first time.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

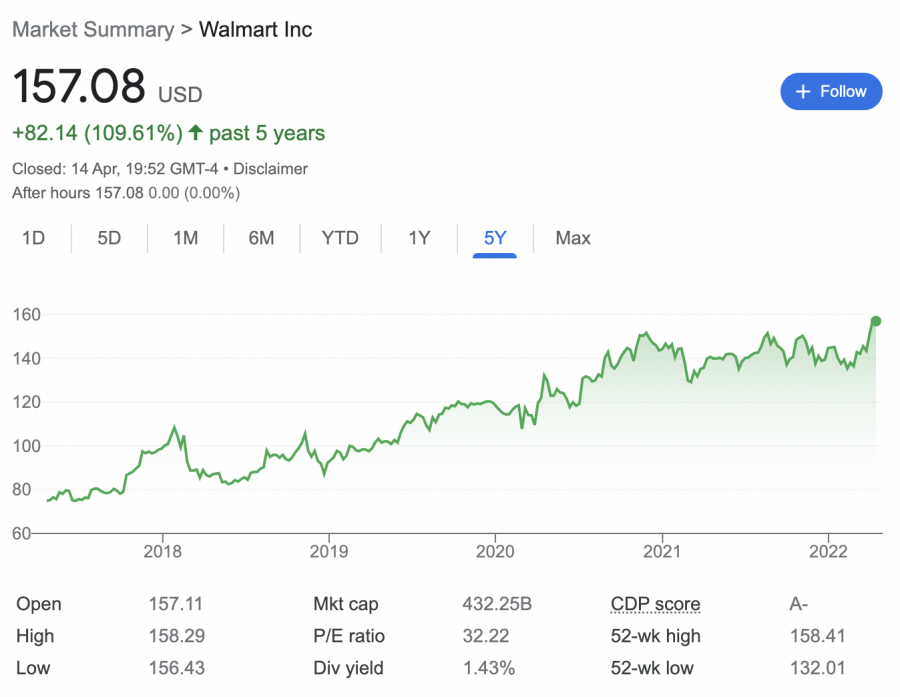

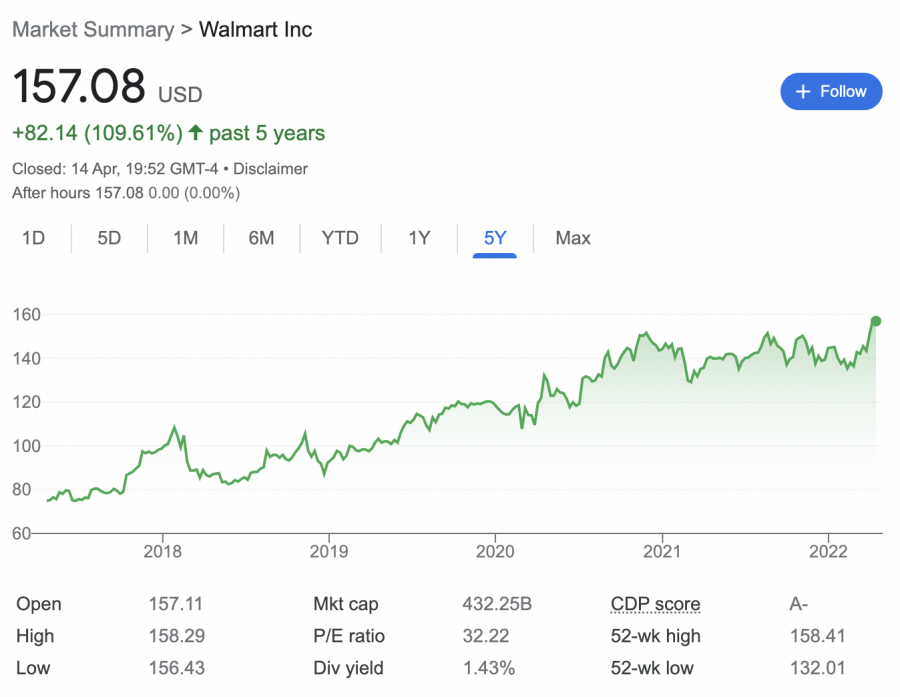

4. Walmart – Best Staple Stock to Invest in

To counter the enhanced risk of investing in high-growth companies, it is also a smart idea to add some staple stocks to your portfolio. These are stocks that sell products or services that will always be in demand. And a great example of a leading staple stock is Walmart.

After all, Walmart dominates the US groceries industry, so its stores experience constant inflows irrespective of how the broader economy is performing. And as such, this makes it a great stock to hold when the wider markets are struggling. In terms of its share price performance, Walmart stocks are up nearly 110% over the prior five years.

Over a 12-month period, growth has been more modest at just 12%. With that said, Walmart is looking to grow its online presence in the coming years to fend off digital retail competitors. Furthermore, Walmart is also a solid dividend stock to invest in. As of writing, a running dividend yield of nearly 1.5% is on offer.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

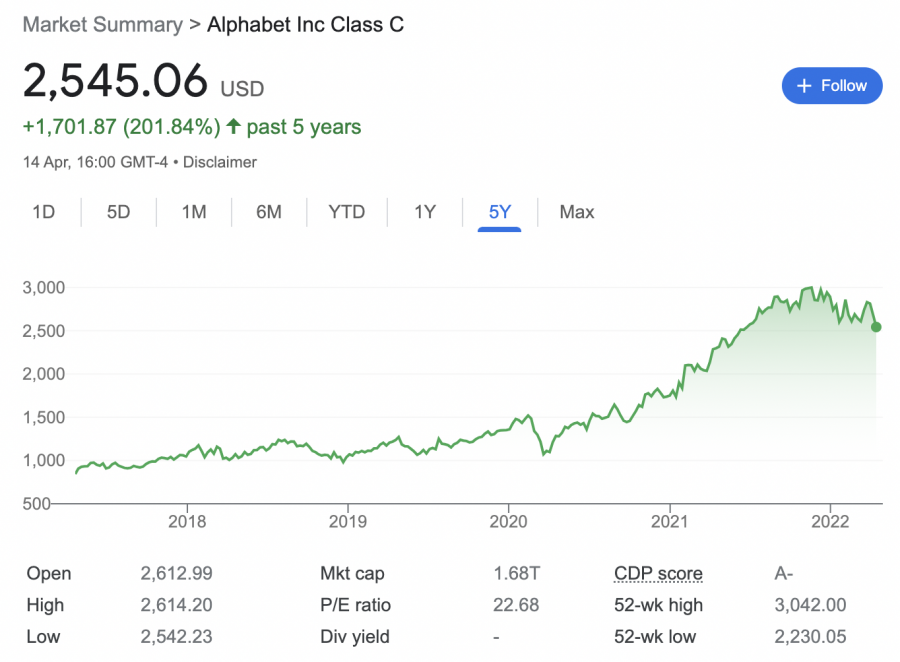

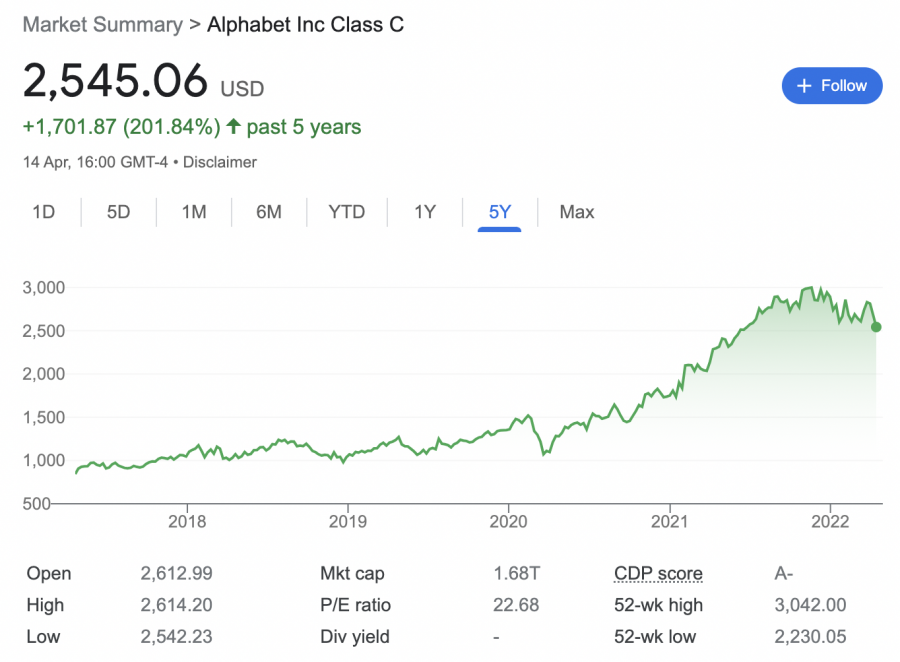

5. Alphabet – Best Stock to Invest for All Economic Cycles

In a similar nature to Walmart, Alphabet – which is the holding company of Google, is able to perform well regardless of the broader economy. In fact, this sentiment was illustrated in the midst of the pandemic, where Alphabet, like many other tech stocks, witnessed a strong upward momentum.

Over the prior five years of trading, Alphabet stocks are up over 200% – which outperforms the wider NASDAQ Composite by some distance. Over a 1-year period, growth has slowed somewhat, with Alphabet stocks up just 10%. Nonetheless, it is important to remember that Alphabet and Google are not only reliant on search engine advertising.

On the contrary, the firm is involved in a range of other innovative products and services. At the forefront of this is the Android operating system, which powers more than 70% of smartphones globally. You then have Google’s cloud computing division, as well as streaming services, AI, maps, and much more.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Are Stocks a Good Investment?

Stocks are not the only investment that you can make. After all, there are many asset classes that give you the opportunity to grow your wealth – including but not limited to ETFs, gold, bonds, CD accounts, and even cryptocurrency.

With this in mind, in the section below we explore whether or not stocks are a good investment to make.

Stocks vs Savings Accounts

Those that are not comfortable taking on additional risk will likely decide to leave their investment funds in a traditional savings account that is insured by the FDIC.

In doing so, you will be lucky to earn more than 1% per year in interest. As such, you won’t be able to outpace ever-growing inflation rates – let alone build your long-term wealth.

In comparison, the stock markets have historically generated significantly better returns than what is available in a savings account.

The best way to illustrate this is to look at the performance of the S&P 500 since it was incepted nearly a century ago. That is to say, since 1926, the S&P 500 has generated average annualized returns of 10% per year.

Easy to Diversify

With thousands of stocks listed in the US and even more when you include the international markets, this makes it easy to create a diversified portfolio.

As we briefly noted earlier, this should include a basket of stocks from a wide variety of sectors – such as information technology, energy, retail, banking, and more.

Moreover, you can then diversify across various share types – such as blue-chip, growth, undervalued, and dividend stocks.

No Prior Experience Needed

Many investment products are somewhat complex and thus – should be avoided unless you have a firm understanding of how the respective instrument works. This includes the likes of options, derivatives, and to some extent – bonds.

However, investing in stocks could not be easier – even if you have no prior investing experience. In fact, it’s just a case of opening a brokerage account, making a deposit, and choosing which stocks you want to add to your portfolio.

Stocks are Liquid

Many assets – including real estate and bonds, are illiquid. This means that in order to cash your money out, there is no knowing how long this will take.

Stocks, on the other hand, are a super-liquid asset class, meaning that you can sell your stocks back to cash at any time during standard market hours. This could come in handy if there comes a time when you need access to fast cash for an emergency.

How do You Make Money From Investing in Stocks?

In terms of making money from stocks – this typically comes in two forms – capital gains and dividends. You can, however, increase the speed at which the value of your portfolio grows by reinvesting your dividends back into the stock market.

We explain how these stock market gains can be realized in the sections below:

Capital Gains

The most obvious way of making money from a stock investment is via capital gains. This is when you sell your stocks for more than you originally paid.

And the profit element of your stock sale is known as capital gains – which are taxable, as we explain shortly.

Here’s an example of how you make money from stocks via capital gains:

- Let’s say that in 2022, you invest in Nike stocks

- At the time of your investment, Nike is trading at $130 per share

- You decide to buy 20 stocks – which amounts to a total outlay of $2,600

- In 2025, Nike stocks are now trading at $280 per share

- You decide to cash out. You have 20 stocks, so you receive $5,600 back

- This means that you made capital gains of $3,000 on this Nike investment

Of course, if the opposite happened and you decided to sell your stocks at a lower price than you originally paid, then you would make a capital loss.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Dividends

Companies that hold excess levels of cash have the capacity to pay dividends. This is a way for a company to share a portion of its retained profits with stockholders.

As such, by holding stocks in a company, you will be entitled to your share of any dividends that the company distributes. In most cases, dividend-paying companies make a distribution every three months.

In some cases, this might be every six months. You might also receive a special dividend, which is in addition to the firm’s usual distribution policy.

Here’s an example of how you can make money from stock dividends:

- Let’s say you decide to buy 20 Johnson & Johnson stocks

- You paid $170 per share, so your total outlay is $3,400

- In the next quarter, management at Johnson & Johnson announce a dividend pay-out of $0.95 per share

- You own 20 stocks, so you will receive a total dividend payment of $19

The best thing about buying dividend stocks is that you will earn income in addition to the aforementioned capital gains. As such, you can grow your wealth in two forms.

Furthermore, as we discuss in the next section, you can compound portfolio gains by reinvesting your dividends back into the stock markets.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Compound Interest

Compounding your investment portfolio by instantly reinvesting your dividend payments – rather than withdrawing the funds out, is one of the most effective stock trading strategies that you can take.

And, the actual process itself is super easy, so you don’t need to have any prior investing experience.

The main concept here is that by reinvesting your dividends back into stocks, any future gains that you make will be boosted. In other words, you will be ‘earning interest on your interest’.

Let’s look at a couple of examples so that you can see the power of compounding interest.

- Let’s say that you invest $10,000 into dividend stocks

- Within one year, you have earned interest totalling 4% of your original investment – so that’s $400

- You decide to withdraw the $400 out of your brokerage account – so you still have a balance of $10,000

- After the second year of holding your dividend stocks, you once again receive an annual yield of 4%

- Once again, you withdraw the $400 out, so your portfolio is still worth $10,000

As you can see from the above example, by constantly withdrawing your dividends out, your stock portfolio will always be worth $10,000. As such, this is hindering your ability to grow your wealth efficiently.

Now let’s see what happens when you reinvest your stock dividends back into the markets.

- You have say invested $10,000 into dividend stocks and after one year, you receive 4% – or $400

- You use that surplus $400 to buy more dividend stocks

- As such, after year one, you now have a portfolio that is worth $10,400

- After year two, you again make 4% in dividends. Only this time, your annual payment amounts to $416

- You again put this back into your stock portfolio, which is now worth $10,816

By repeating the above strategy – where you reinvest your dividends back into the markets, then your portfolio has the potential to grow at a much faster rate.

And, perhaps most importantly, you will also amplify the capital gains that your portfolio generates – as you will essentially own more stocks.

Are Stocks Investments Taxed?

Whether or not you need to pay tax on your stock investments – as when and at what rate, will vary wildly depending on your personal circumstances. Moreover, the specifics surrounding tax will vary from country to country.

Nonetheless, the vast majority of tax authorities – especially those based in the US, UK, Europe, Canada, and Australia, will tax you on realizable gains. This means that the tax is typically due when you receive your proceeds.

- For example, capital gains tax is generally not liable until you actually cash out your stocks.

- This means that you will not pay tax for as long as you hold the stocks in your portfolio.

- Moreover, even when you do cash out your stocks, if the stocks were held in a retirement account, then certain tax advantages are likely to kick in.

- In the US, for example, there are a variety of Individual Retirement Accounts (IRAs) that enable you to shield your tax liabilities.

- In the UK, a similar approach can be achieved via an Individual Savings Account (ISA).

When it comes to dividends, unless your stocks are held in a suitable retirement account, then you will likely need to pay tax on the proceeds received in the respective financial year.

Ultimately, if you’re looking to create a stock investment portfolio for the first time, then it’s best to speak with a tax specialist to assess how this will impact your personal circumstances.

How Much Does it Cost to Invest in Stocks?

We mentioned earlier that the only way to invest in stocks is via an online broker. And naturally, online brokers are in the business of making money. The charges that you are required to pay will vary from broker to broker.

Nonetheless, for a quick overview of what you will need to pay to invest in the stock market – read on:

Funding

Before you even get to add stocks to your newly created brokerage account, you might incur funding fees. At Webull, for instance, $8 is charged on domestic bank wire deposits. When withdrawing via the same payment method, $25 is charged.

At eToro, US clients can deposit and withdraw funds via all supported payment methods – which includes debit/credit cards, without paying a cent in fees.

Commissions

Commissions are related to stock trading fees that you pay on each buy and sell position.

- For example, if your chosen broker charges a commission of 0.50% and you invest $1,000 – you will pay a fee of $5 to enter the market.

- If you decide to cash out the stocks when they are worth $2,000, your 0.50% commission will amount to $10.

The good news is that many brokers in the US – including eToro and Webull, enable you to invest in stocks on a 0% commission basis. On the other hand, virtually all US brokers will charge you a commission when you invest in foreign stocks.

The only exception to this rule – as per our market research, is eToro – which offers 0% commission on both US and international exchanges.

Spreads

While many US brokers offer 0% commission on US-listed stocks, you will always need to pay a spread. This is a hidden fee that is calculated by taking the difference between the ‘bid’ and ‘ask’ price of a stock.

The wider this gap is, the more you need to pay. More specifically, if the spread amounts to 1%, then this means that you need to make gains of 1% just to get to the break-even point.

As such, as soon as you open a stock trade, it will be at a loss, to an amount equal to the spread.

How Much Money Do You Need to Invest in Stocks?

Prior to the growth of online-only brokers that cater their services to retail clients, the stock markets were somewhat difficult to invest in for the casual trader.

Not only would you need to meet a minimum deposit that often amounted to thousands of dollars, but you would need to purchase a minimum number of stocks to invest.

As such, investing in expensive stocks like Amazon and Tesla would not be possible for somebody on a budget. The good news is that there are now many budget-friendly brokers in the market that support low or even zero deposits.

Moreover, and perhaps most importantly, there is no longer a requirement to buy stocks in minimum lot sizes. In fact, you do not even need to purchase a full stock anymore, as you can invest via fractional shares.

- For those unaware, this allows you to buy a small fraction of one stock.

- For instance, at eToro, you can invest any amount from just $10.

- This means that instead of needing to invest $3,000 into one Amazon stock, you can risk just $10 – which would amount to 0.3% of a share.

When you invest in fractional shares, your profit and loss figures work out in exactly the same way.

For instance, if you invest $10 into Amazon stock and the firm’s share price increases by 50%, your money will now be worth $15. Moreover, if you buy fractional stocks and the company distributes a dividend, you will still be entitled to your share.

Top Tips for Investing Stocks for Beginners

If you’re still learning how to invest in stocks and you need some guidance on how to proceed in the best way possible – consider the five tips outlined below.

Explore Stock Index Funds

On the one hand, the process of investing in the stock markets is very straightforward. In fact, it takes just five minutes from start to finish when using a new-age broker like eToro.

However, the key challenge is knowing which stocks to invest in – especially when you consider the sheer number of options in this marketplace. With this in mind, if you do not have any prior experience in researching stocks, it might be worth investing in an index fund.

In a nutshell, index funds often contain hundreds, if not thousands of individual stocks. You can indirectly invest in all of the stocks held by an index fund via a single trade.

Moreover, the fund that manages the index will maintain and rebalance your portfolio on your behalf. As such, you will be investing in the stock markets passively. The most popular index fund in the stock market is the S&P 500.

This fund contains 500 large-cap companies that trade in the US – which covers everything from Tesla, Amazon, and IBM to McDonald’s, Nike, and Apple.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Buy Market Dips

The emotional side of stock trading can often make or break a new investor. That is to say, many inexperienced investors will panic sell their stocks when the markets are down.

Not only should you avoid panic selling, but when prices are down you should consider investing more money into the markets. This is known as buying the dip – and when you invest in high-grade stocks when prices are down – you are entering the market at a discount.

- For example, in February 2020, high-grade stock Coca-Cola went from a price of $60 per share to $38 just one month later.

- This was because of a broader market sell as per the fears associated with COVID-19.

- As of writing in early 2022, Coca-Cola is trading above $65.

- This means that had you invested in Coca-Cola stocks when it was priced at $38 in March 2020 – you would now be looking at gains of 70%.

Moreover, as you are able to buy more stocks with less money when the markets are down, this means that you will receive additional dividend payments when distributions are made.

Copy Trading

One of the most effective ways to invest in the stock markets as a complete newbie is to consider a copy trading tool. This enables you to ‘copy’ successful traders that have a proven track record.

The best copy trading platform in the market is eToro – which gives you access to thousands of verified investors. Once you have chosen an investor to copy, any future trades will automatically be mirrored in your own portfolio.

For example:

- You decide to invest $2,000 into a seasoned stock trader that uses the eToro platform

- The trader risks 10% of their portfolio into Apple stocks and 20% into Southwest Airlines.

- You copy the same trade – but proportionate to the amount you invested

- As such, you buy $200 worth of Apple stocks. You also invest $400 into Southwest.

Another reason why eToro offers the best copy trading platform is that no additional fees are charged. As such, you are not required to pay your chosen trader a commission on profitable investments.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Focus on Hot Sectors

If you are happy to be somewhat active when investing in the stock markets, then another strategy to consider is to focus on hot and trending sectors.

For example, as of writing, one of the hottest sectors to invest in is energy. This is because oil is at record prices, so naturally, stocks operating in this sector are likely to perform well.

In another example, in the midst of the pandemic, there were many stocks that benefited from the stay-at-home economy. This included tech stocks like Amazon and Facebook, as well as home-based solutions like Zoom and Peloton.

However, when you focus on cyclical stock cycles, it is important that you find the best possible opportunity to cash out. After all, many of the companies that benefited from increased lockdown measures have since seen their stock prices reverse.

Stick to Strict Dollar-Cost Average Strategy

Being disciplined when learning how to invest in stocks is crucial – not only in terms of avoiding panic selling but sticking to a plan. And, one of the best plans that you can undertake is to dollar-cost average your investment at fixed intervals.

For example, let’s suppose that you have calculated that based on your current salary and living expenses, you have $300 in surplus income that you can inject into your portfolio.

By investing this $300 into the stock markets, you will continuously build the value of your portfolio as each month passes. Furthermore, and perhaps most importantly, each investment will yield you a different cost price.

This means that you can avoid worrying about shorter-term price spikes, as you won’t be reliant on cyclical cycles. Instead, you can just sit back and ride out short-term volatility over the course of many years.

Conclusion

In summary, instead of leaving your money in a traditional savings account that yields less than 1% in interest each year – consider gaining exposure to the stock markets. In doing so, a long-term investment plan will give you the best chance possible of creating a nest egg.

With new-age brokers like eToro requiring just $10 per trade – you can get the ball rolling right now without needing to have a large amount of capital saved. Best of all, eToro offers its 0% commission policy across thousands of stocks – both in the US and overseas. As such, creating a diversified stock investment portfolio has never been easier.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

FAQs when Investing in Stocks

How do I invest in stocks for the first time?

What are the best stocks to invest in?

Can I invest in stocks with just $100?

Should I invest in stocks?

What is the best platform for investing in stocks?

Is investing in stocks haram?

How to invest in penny stock?

from WordPress https://ift.tt/gmAlJv1

via IFTTT

No comments:

Post a Comment